In this thread, the focus is on high impact calendar events related to Bitcoin. Participation is welcomed!

Upcoming:

Upcoming:

- FOMC Meeting - March Preview: https://www.cryptocraft.com/thread/p...4#post14801304

Archive:

- FOMC Meeting - September Preview: https://www.cryptocraft.com/thread/p...4#post14583704

- FOMC Meeting - July Preview: https://www.cryptocraft.com/thread/p...5#post14510805

- FOMC Meeting - June Preview: https://www.cryptocraft.com/thread/p...5#post14460145

- FOMC Meeting - May Preview: https://www.cryptocraft.com/thread/p...4#post14414034

- US Employment Data - April Preview: https://www.cryptocraft.com/thread/p...1#post14387851

- FOMC Meeting - March Preview - https://www.cryptocraft.com/thread/p...3#post14369263

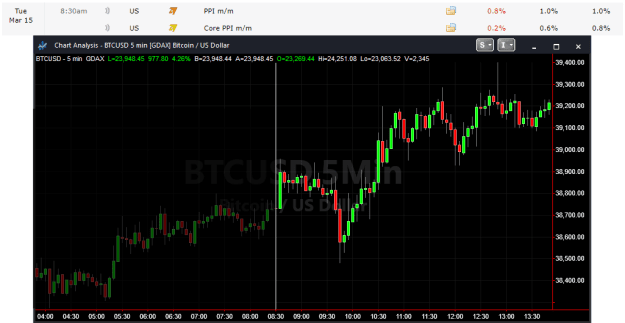

- US PPI - February Preview - https://www.cryptocraft.com/thread/p...7#post14326657

- US Retail Sales - February Preview - https://www.cryptocraft.com/thread/p...6#post14325776

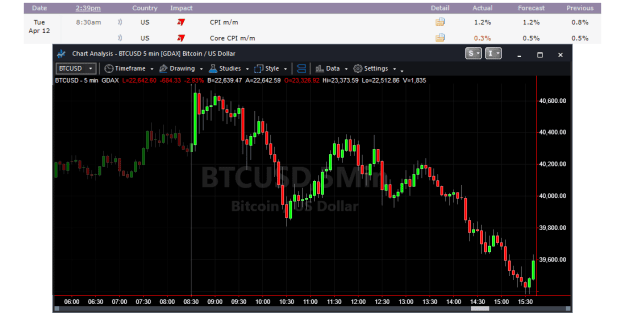

- US CPI - February Preview: https://www.cryptocraft.com/thread/p...5#post14324145

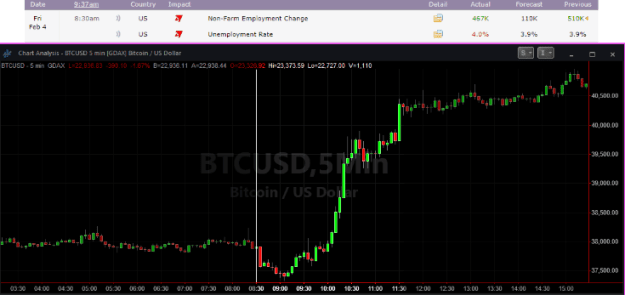

- US Employment Data - February Preview: https://www.cryptocraft.com/thread/p...1#post14311151

- FOMC Meeting - February Preview: https://www.cryptocraft.com/thread/p...6#post14307686

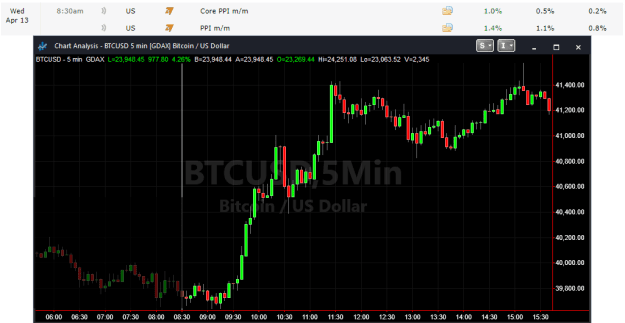

- US PPI - January Preview: https://www.cryptocraft.com/thread/p...9#post14291189

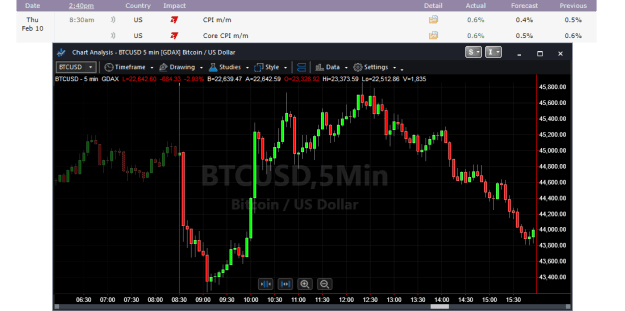

- US CPI - January Preview: https://www.cryptocraft.com/thread/p...3#post14284363

- US Employment Data - January Preview: https://www.cryptocraft.com/thread/p...2#post14277372

- FOMC Meeting - December Preview: https://www.cryptocraft.com/thread/p...5#post14255595

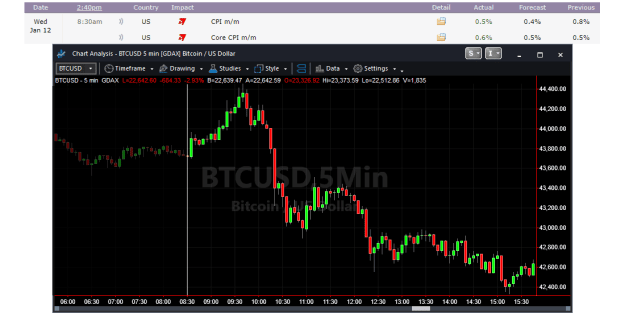

- US CPI - December Preview: https://www.cryptocraft.com/thread/p...7#post14252557

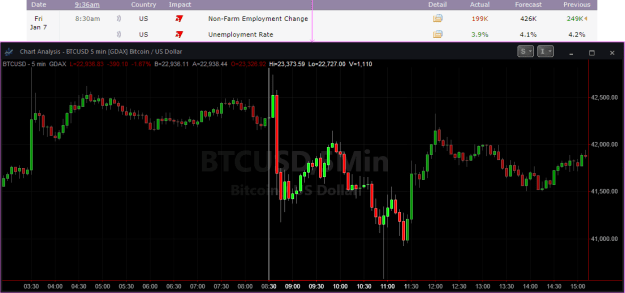

- US Employment Data - December Preview: https://www.cryptocraft.com/thread/p...4#post14241184

- US Core PCE Price Index - November Preview: https://www.cryptocraft.com/thread/p...8#post14239908

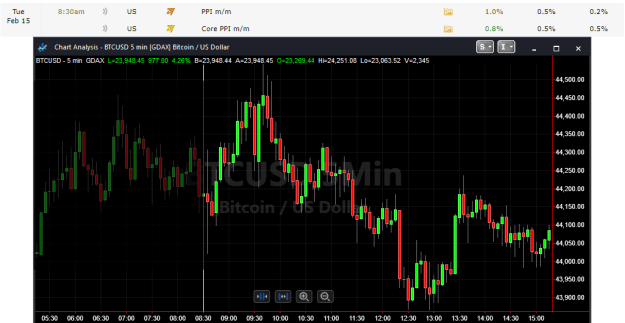

- US PPI - November Preview: https://www.cryptocraft.com/thread/p...4#post14222254

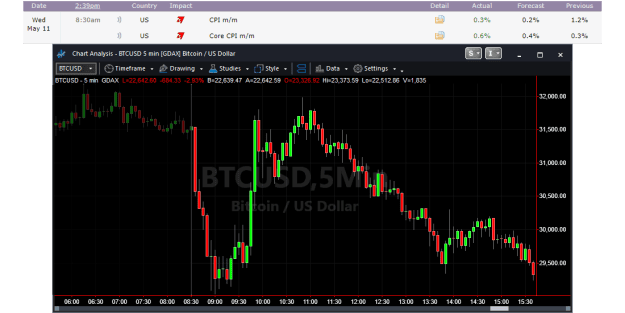

- US CPI - November Preview: https://www.cryptocraft.com/thread/p...9#post14216919

- US Employment Data - November Preview: https://www.cryptocraft.com/thread/p...1#post14209271

- FOMC - November Preview: https://www.cryptocraft.com/thread/p...4#post14205234

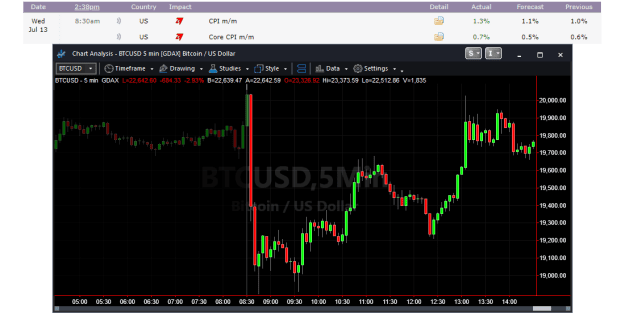

- US CPI - October Preview: https://www.cryptocraft.com/thread/p...6#post14177096

- US PPI - October Preview: https://www.cryptocraft.com/thread/p...3#post14174653

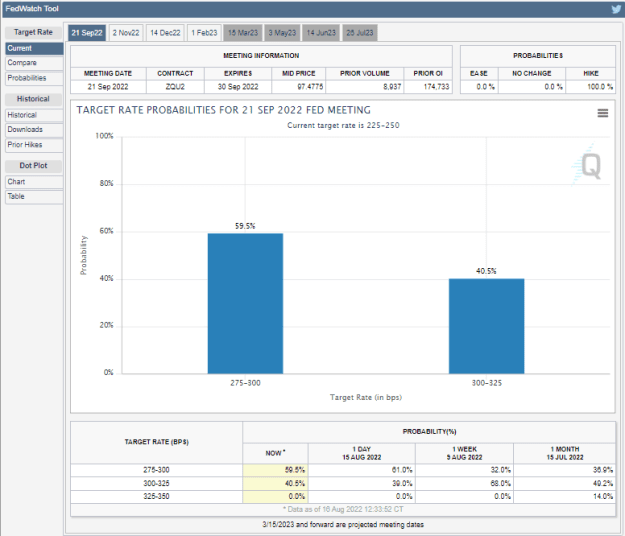

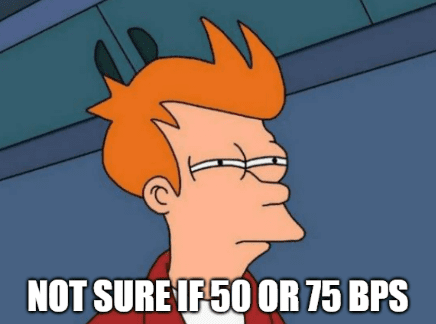

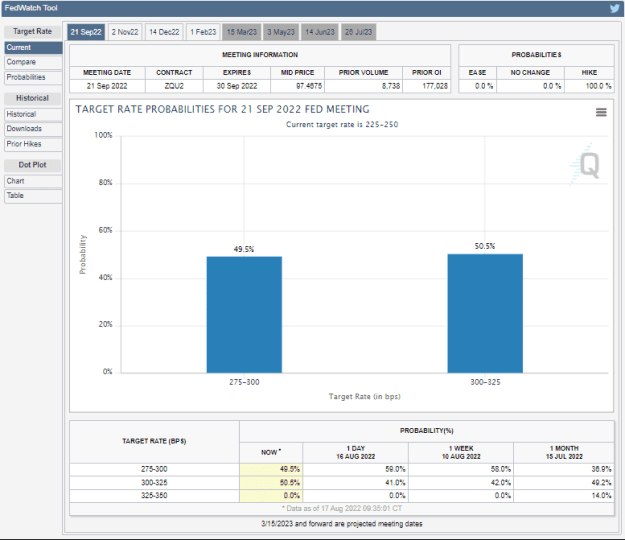

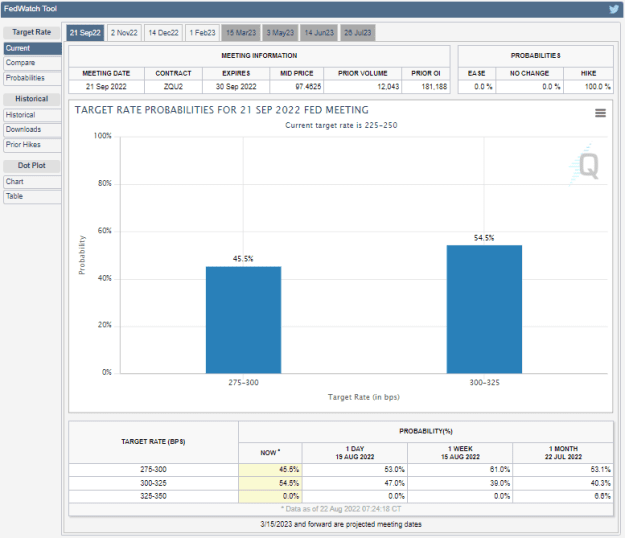

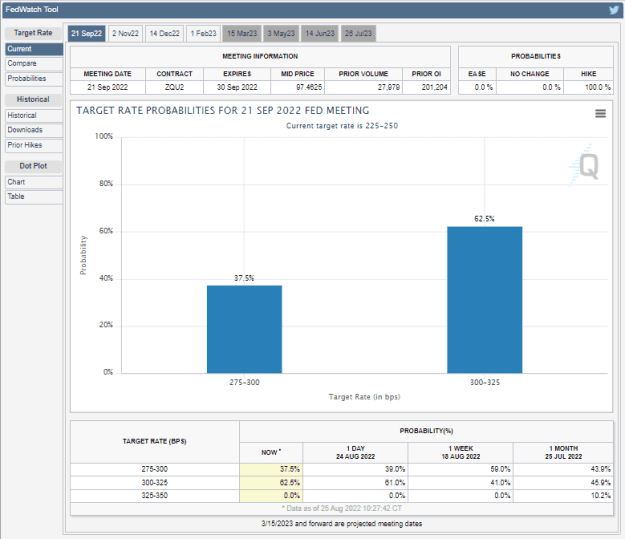

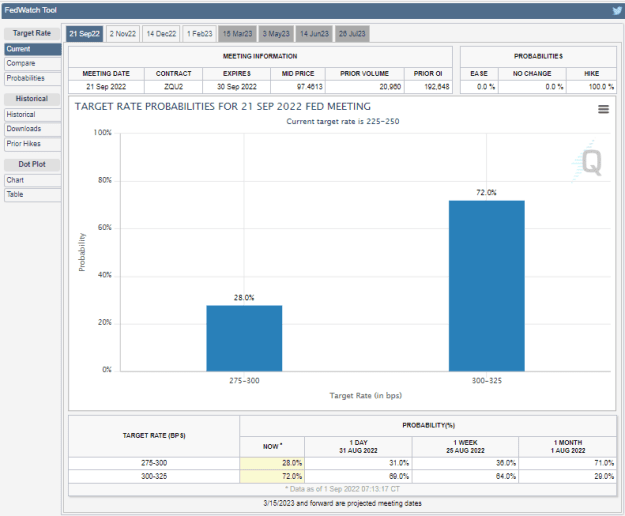

- FOMC - September Preview: https://www.cryptocraft.com/thread/p...6#post14144586

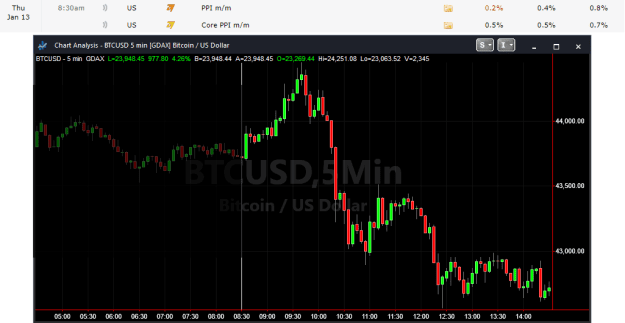

- US PPI - September Preview: https://www.cryptocraft.com/thread/p...7#post14135797

- US CPI - September Preview: https://www.cryptocraft.com/thread/p...6#post14133906

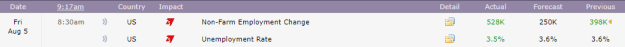

- US Employment Data: September Preview: https://www.cryptocraft.com/thread/p...6#post14121356

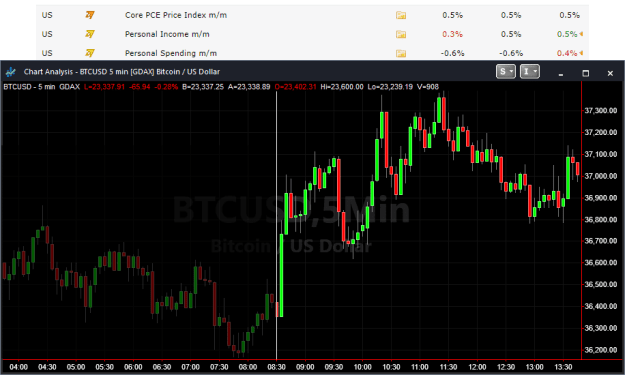

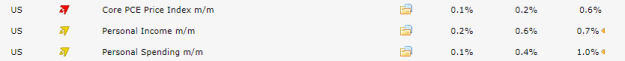

- US Core PCE Price Index: August Preview: https://www.cryptocraft.com/thread/p...6#post14113556

- FOMC Meeting Minutes: August Preview: https://www.cryptocraft.com/thread/p...6#post14102726

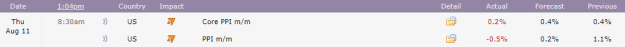

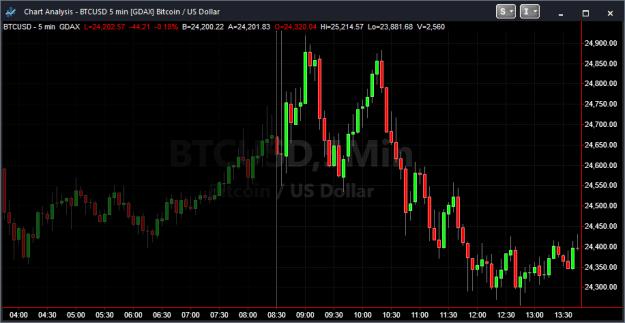

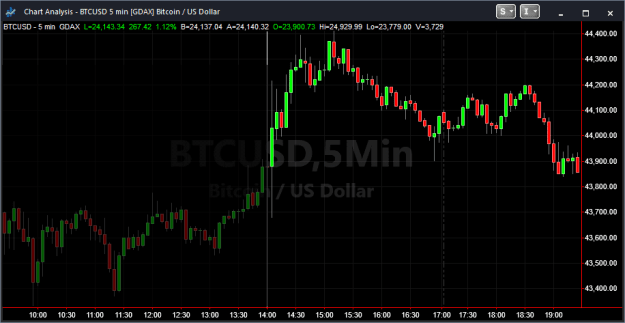

- US PPI data - August Preview: https://www.cryptocraft.com/thread/p...0#post14096130

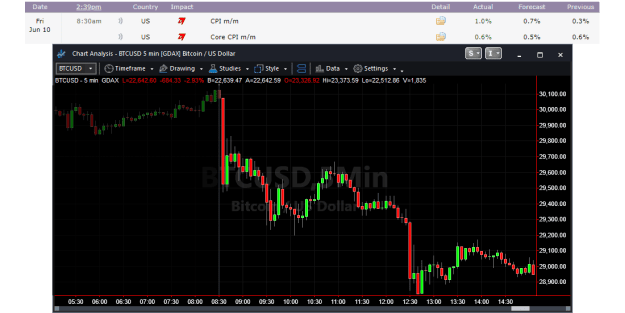

- US CPI - August Preview: https://www.cryptocraft.com/thread/p...9#post14094099

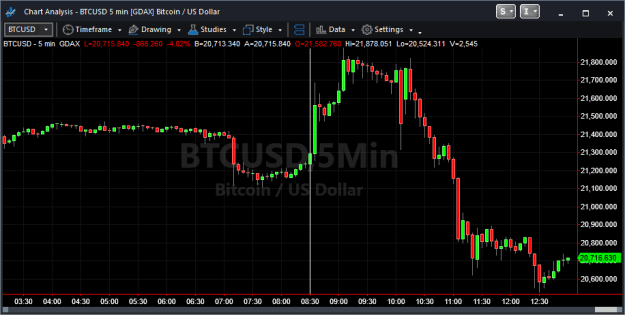

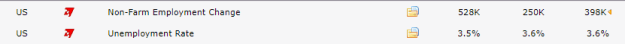

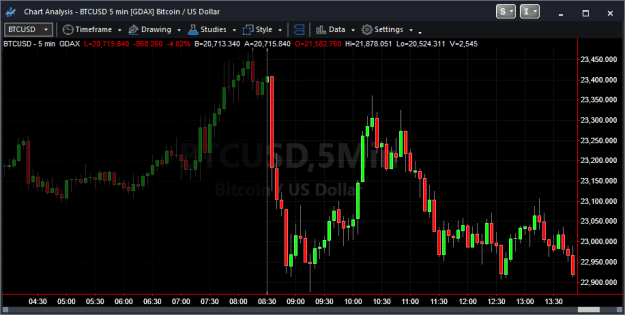

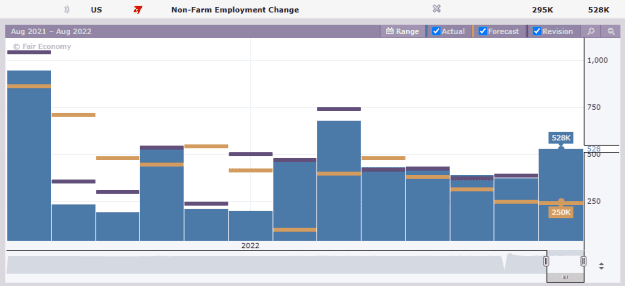

- US Employment Data: August Preview: https://www.cryptocraft.com/thread/p...2#post14089552

We must learn who is gold, and who is gold plated