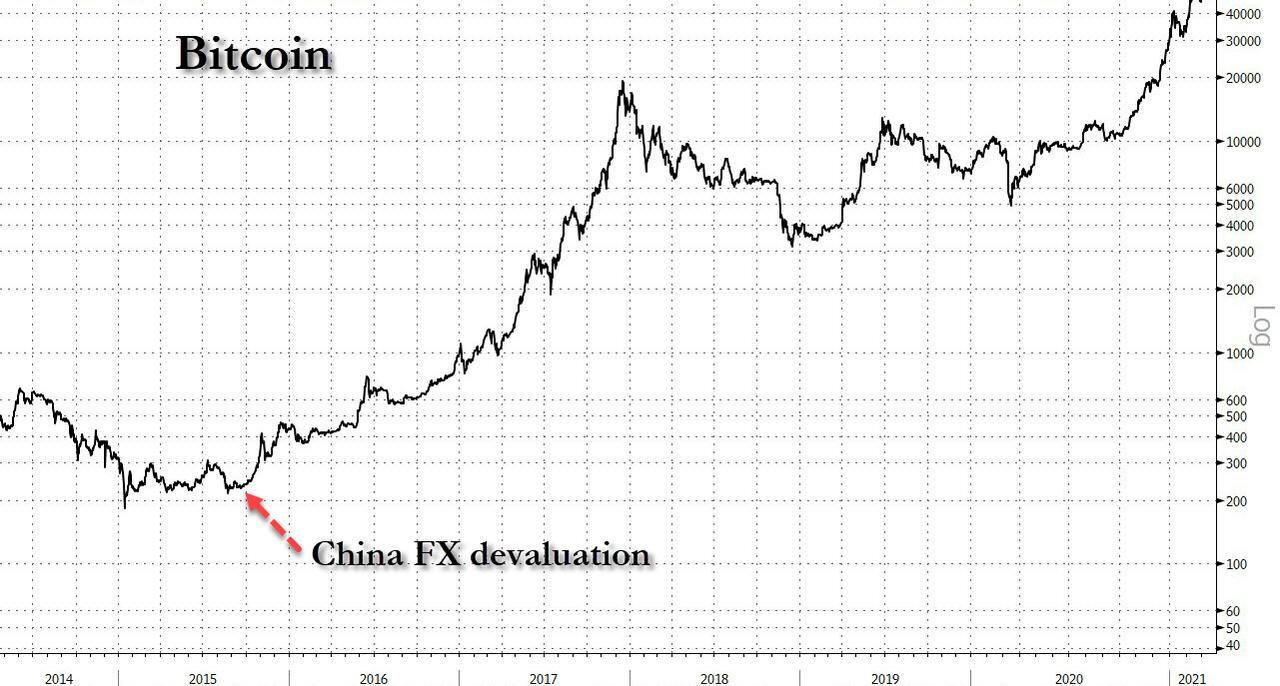

Last October, when we pointed out that China's FX outflows had just hit a whopping $75BN - the single biggest monthly outflow since the 2015 currency devaluation - we concluded that the "unfavorable interest rate spread between China and the US will "likely imply persistent depreciation and outflow pressures in coming months", or in other words, September's biggest FX outflow in years is just the beginning, and very soon - in addition to geopolitics and central banks - the world will also be freaking out about the capital flight out of China... not to mention where all those billions in Chinese savings are going and which digital currency the Chinese are using to launder said outflows."

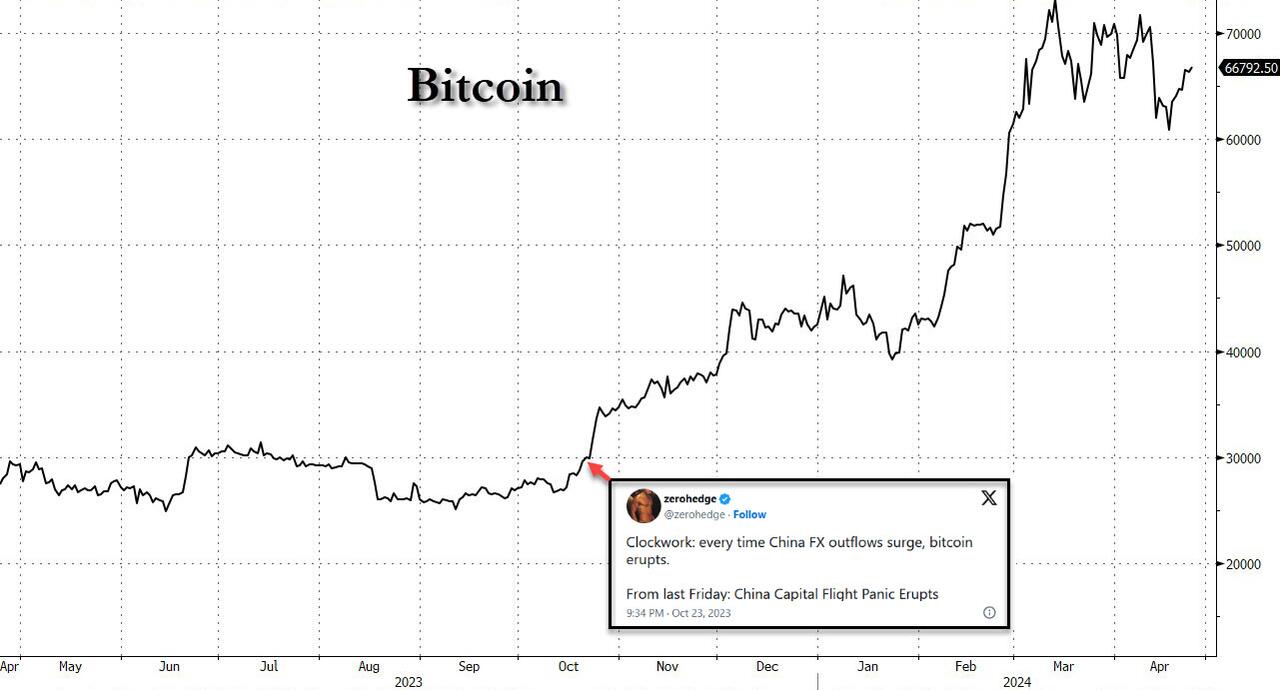

We wrote that on October 20 when Bitcoin was trading just under $30,000, a level it had been for much of 2023. And, just as we correctly predicted at the time...

... following this surge in Chinese FX outflows, bitcoin - traditionally China's preferred means to circumvent Beijing's great capital firewall since gold is, how should one put it, a bit more obvious when crossing borders - promptly exploded more than 100% higher in the next 4 months.

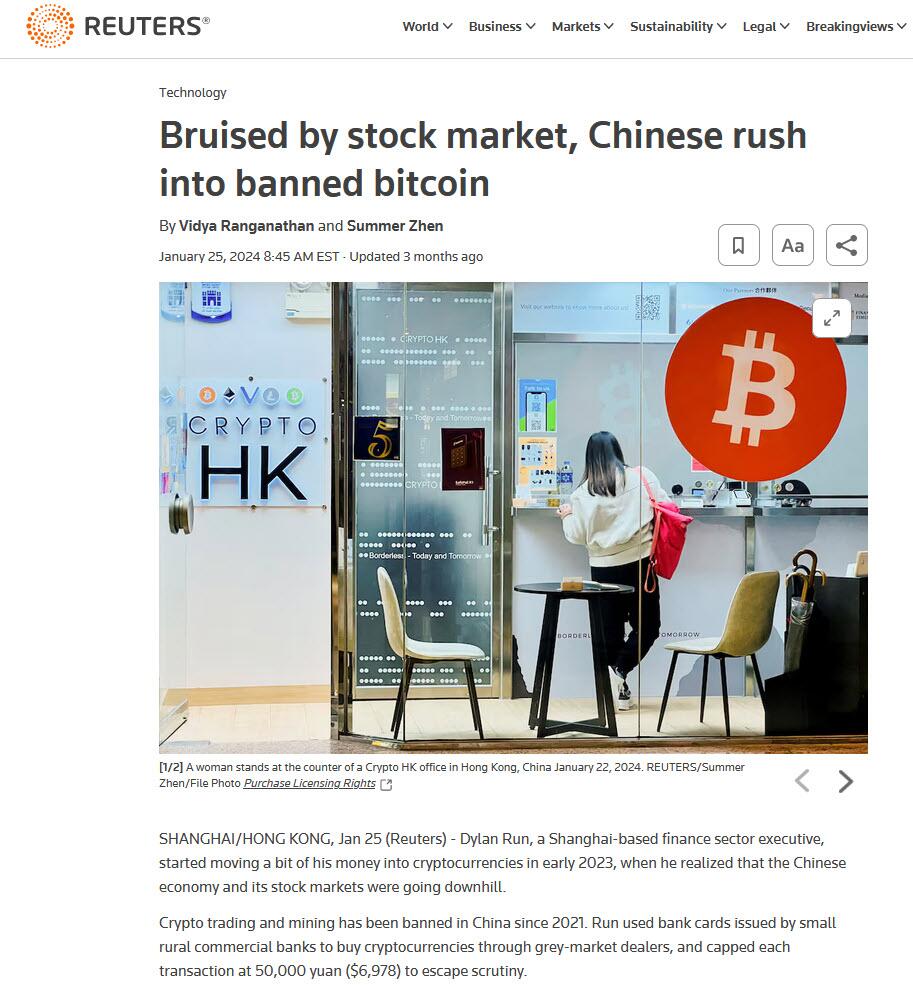

And while conventional wisdom is that this surge in the price of the digital currency was largely due to the January launch of Bitcoin ETFs, what many missed was a Reuters story in January which confirmed our thesis from back in 2015, according to which much more than ETFs, and much more than rapidly shifting sentiment or frankly any day-to-day newsflow, it is China's massive wall of inert capital that has been the biggest driver of bitcoin moves, and never more so than during periods of FX and capital outflows which usually precede some form of capital controls.

We bring all this up because six months after our first correct prediction that China's spike in FX outflows would send bitcoin surging, it's time to do it again.

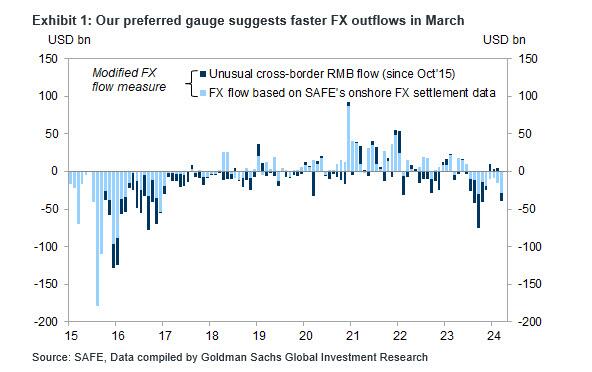

One wouldn't know if, however, if one merely looked at the official Chinese FX reserve data published by the PBOC, here nothing sticks out. In fact, at $3.246 trillion, reported Chinese reserves are now near the highest level in past four years, and monthly flows are very much stable as shown in the chart below.

The problem, of course, is that as we have explained previously China's officially reported reserves are woefully (and perhaps purposefully) inaccurate of the bigger picture.

Instead if one uses our preferred gauge of FX flows, one which looks at i) onshore outright spot transactions; ii) freshly entered and canceled forward transactions, and iii) the SAFE dataset on “cross-border RMB flows, we find that China's net outflows were $39bn in March, up from $11bn in February and the fastest pace of outflows since the September spike in FX outflows which we duly noted half a year ago.

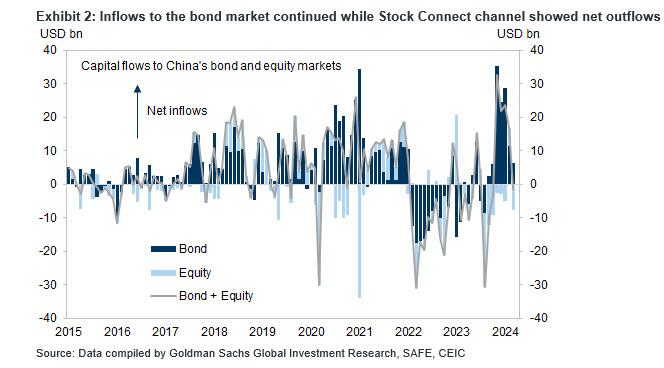

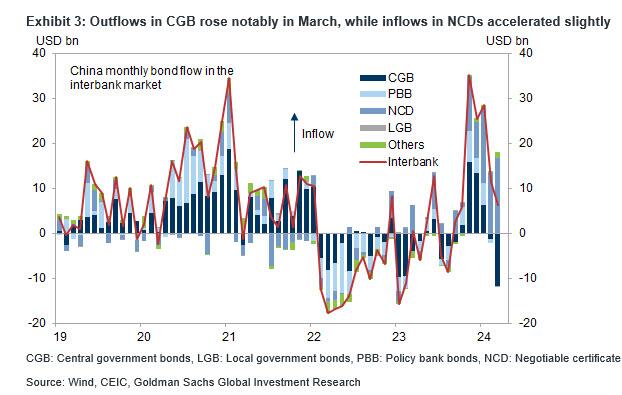

How did we get this number? The portfolio investment channel showed net outflows in March. The Stock Connect channel showed net outflows of US$8bn vs. US$5bn inflows in February, and inflows to the bond market slowed in March (US$6bn, vs. US$11bn in February)...

... primarily on record net selling of central government bonds.

Finally, the current account channel showed also net outflows in March, mainly as services trade related outflows picked up.

At the time when FX outflows were re-acclererating, the broad USD strengthened further in March, and USD/CNY spot drifted higher, as one would expect when there is capital flight... Oh, and Bitcoin hit a record high above $70K.

And while Chinese policymakers are still keen on maintaining FX stability - the countercyclical factors in the daily CNY fixing remained deeply negative and front-end CNH liquidity tightened notably in recent weeks - the reality is that with China desperate to boost its exports at a time when its great mercantilist competitor, Japan, has hammered the yen to the lowest level in 3 decades, it is only a matter of time before the currency devaluation advocates win, as they did in 2015.

ADVERTISEMENT

We hope that we don't have to remind readers that the first big trigger for bitcoin's unprecedented eruption higher starting in 2015 was - you guessed it - China's August 2015 FX devaluation.

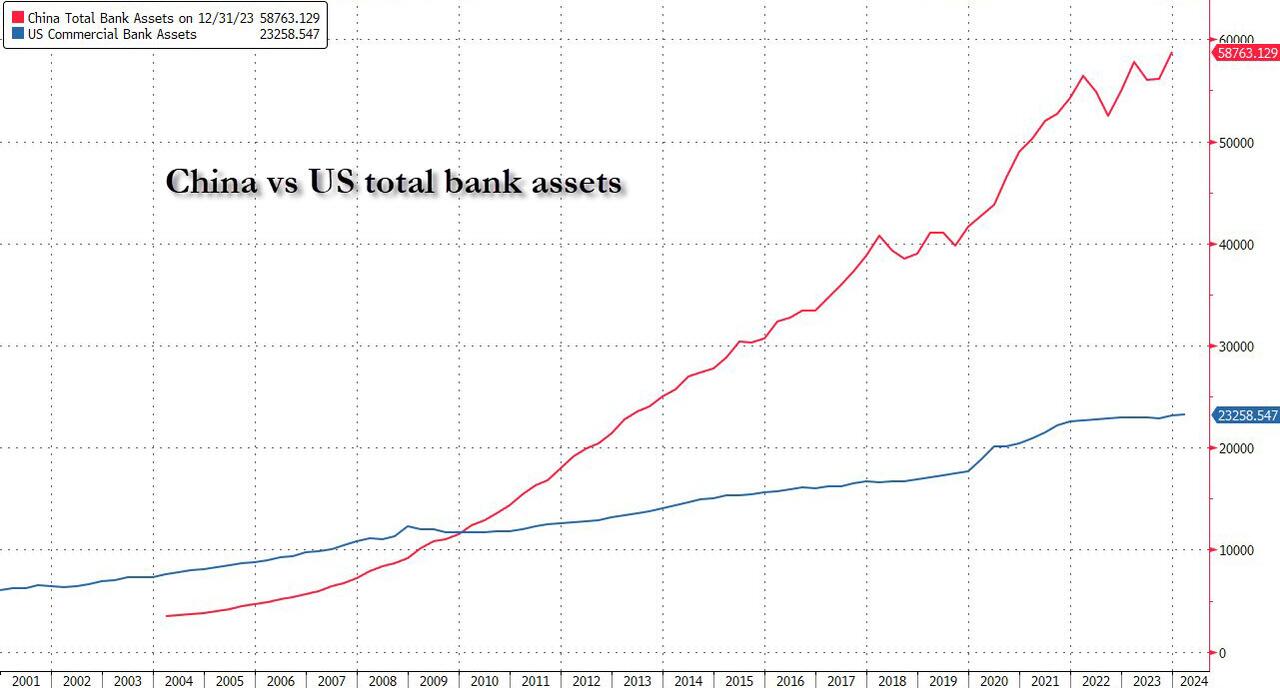

So don't be surprised if in the next 6 months Bitcoin doubles again, and the move has nothing to do with ETF inflows, the halving, or frankly anything else taking place in the US... and instead is entirely driven by China's massive wall of money which at last check was almost 3x bigger than the US.

By Zerohedge.com

More Top Reads From Oilprice.com:

- China Scooped Up Record Volumes of Russian Oil In March

- Red Sea Could be Where Israel Strikes Next

- Nuclear Tensions Rise as Poland Offers Territory for NATO Warheads