Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

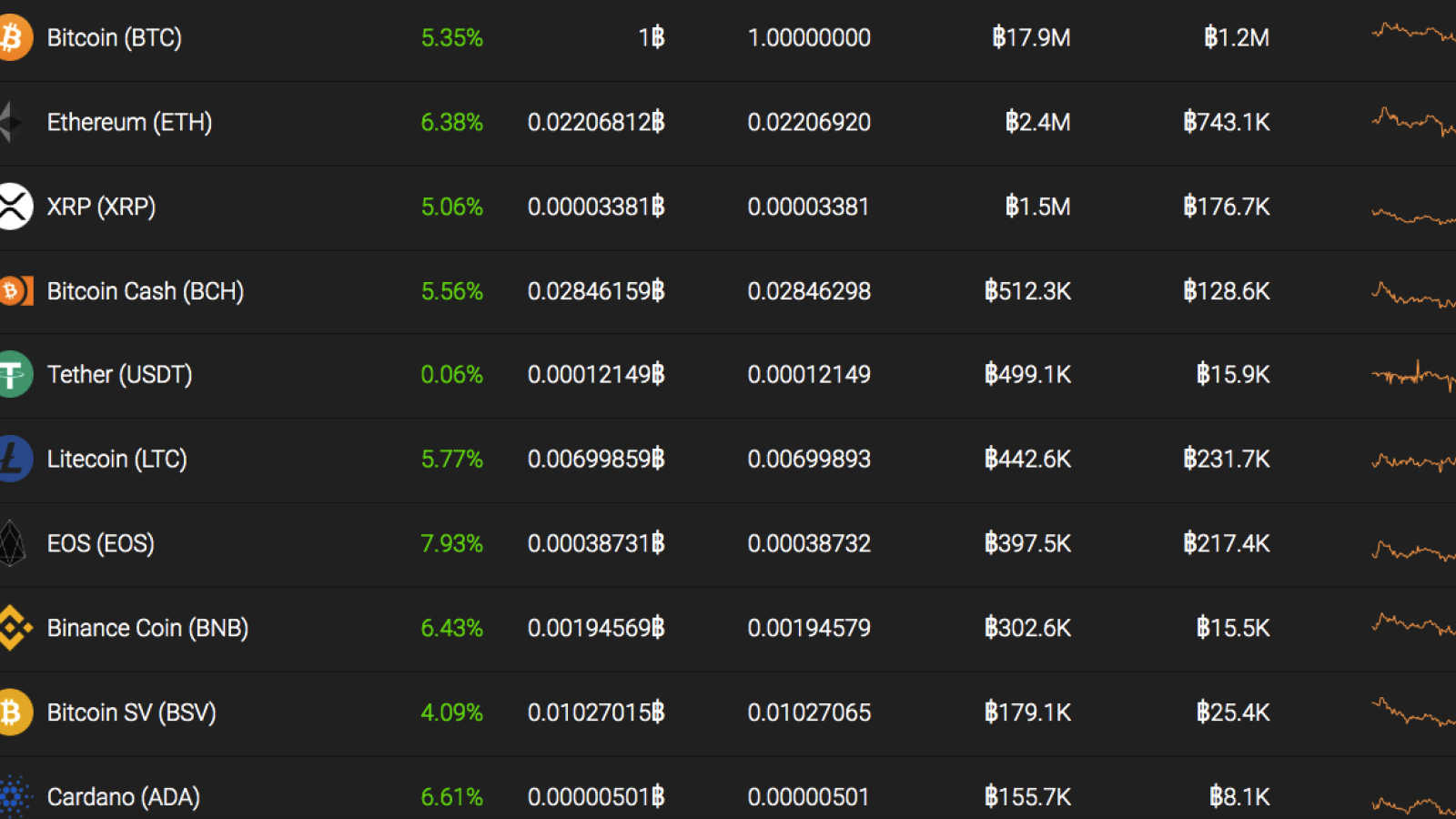

While Bitcoin is slowly but surely going up, altcoins are not losing their chances and keeping up with the growth of the first top crypto. Moreover, the rates of the top 10 coins are located in the green zone in correlation to BTC. The biggest gainer is EOS whose price has rocketed by almost 2.57% over the last 24 hours.

The key indicators of Litecoin, EOS, TRX, and LINK are looking the following way.

|

Name |

Ticker |

Market Cap |

Price |

Volume (24h) |

Change (24h) |

|

Litecoin |

LTC |

$3 666 598 298 |

0,00698751 BTC |

$2 895 245 497 |

0,38% |

|

EOS |

EOS |

$2 987 886 529 |

0,00038625 BTC |

$1 908 912 247 |

2,57% |

|

TRON |

TRX |

$1 082 359 539 |

0,00000196 BTC |

$747 035 094 |

3,76% |

|

Chainlink |

LINK |

$821 810 597 |

0,00028379 BTC |

$193 771 318 |

2,94% |

LTC/BTC

Even though Litecoin has been located in the green zone over the last day, it keeps trading within the descending channel.

On the 1D chart, the price of the ’digital silver’ declined deeper every time after each bounceback. Such a tendency is confirmed by the decreasing trading volume. Currently, LTC is trying to fix at the resistance level at 0.007 BTC. However, one should expect a potential decline in the area at

0.006 BTC soon due to the absence of the buying volume.

Litecoin is trading at 0.006895 BTC at press time.

EOS/BTC

EOS is the biggest gainer today out of the top 10 coins, its price has increased by 2.57% over the last 24 hours. The price of the asset has been located in the uptrend channel since September 25.

According to the chart, EOS is about to face a correction soon as the coin has been decreasing without any significant rollback. Besides, the RSI indicator is located on the verge of the overbought zone, suggesting an upcoming decline. Summing up, EOS is likely to trade within the corridor between 0.00037 BTC and 0.00038 BTC until mid-October.

EOS is trading at 0.0003866 BTC at press time.

TRX/BTC

After a continued decline started at the beginning of June, TRX is trying to show short-term growth. Its rate has gone up by more than 3% over the last day against Bitcoin.

On the 1D chart, the quotes have been located in the uptrend since the end of September. The rising MACD indicator also confirms the ongoing price rise.

Furthermore, the trading volume index is coming back to its previous high positions. In this regard, TRX is likely to reach the level of 210 satoshi in a few weeks.

TRX is trading at 0.00000196 BTC at press time.

LINK/BTC

LINK is also in the list of the gainers. Its rate has gone up by around 3% over the last day.

On the 1D chart, LINK is located in the overbought area according to the RSI indicator. Regarding the nearest price scenario, the rate is about to be corrected to the closest support zone at 0.00025 BTC. Such a scenario might happen until the end of October.

LINK is trading at 0.0002780 BTC at press time.