Bitcoin and Ethereum: Three-day bearish trend

- The price of Bitcoin continues its three-day bearish trend, and during the Asian session, we saw a drop below the $23,000 support zone yesterday.

- Yesterday, the price of Ethereum fell below the $1700 level, retested at that level and continued the pullback towards the $1600 level.

- Crypto markets tumbled on Tuesday as geopolitical tensions dampened investors’ appetite for risk and excitement over the Ethereum merger began to wane.

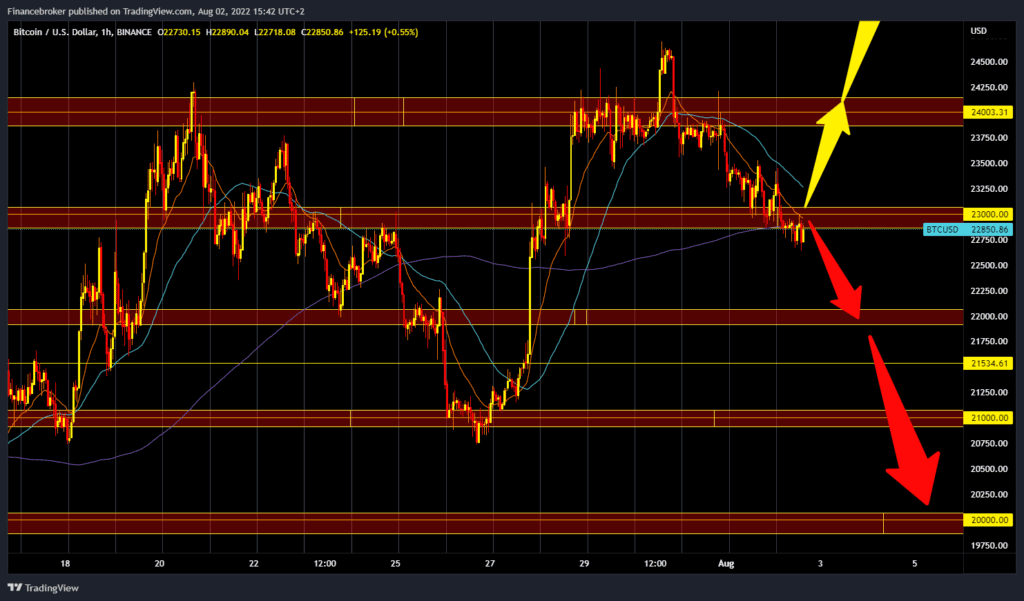

Bitcoin chart analysis

The price of Bitcoin continues its three-day bearish trend, and during the Asian session, we saw a drop below the $23,000 support zone yesterday. Additional pressure is created by the fact that the price of Bitcoin has fallen below the MA200 moving average. There is a noticeable increase in fear, which could further increase the pressure on the already vulnerable Bitcoin. Our next bearish target is the $22,000 support level. If he does not provide us with sufficient support, the bitcoin price will probably fall to the previous low of $21,000. For a bullish option, we need a new positive consolidation and to hold above the $23,000 level. After that, we can expect the price to continue its recovery, and our target is the $24,000 level again.

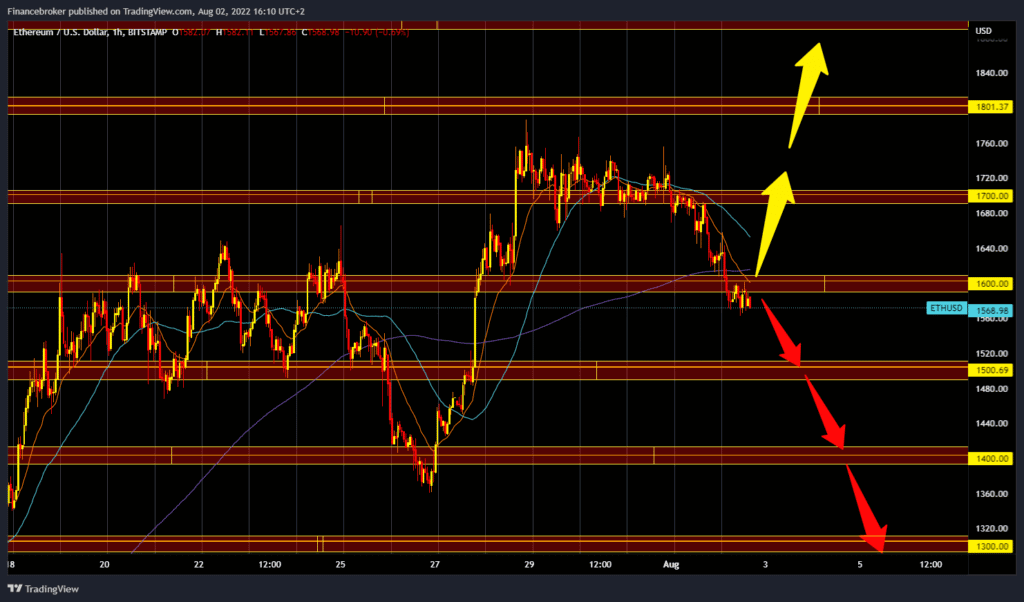

Ethereum chart analysis

Yesterday, the price of Ethereum fell below the $1700 level, retested at that level and continued the pullback towards the $1600 level. Today, the bearish pressure continued, and the price dropped below the $1600 level and is now maintained in the $1570-1600 range. The moving averages have moved to the upside and are directing the price towards the $1500 support zone. Last week’s low was at $1360. We need a new positive consolidation and a return above the $1600 level for the bullish option. It is then necessary to hold above in order to catch a new run for the next bullish impulse. After that, our target is $1700 again, then $1800 as the next higher high.

Market overview

Crypto markets tumbled on Tuesday as geopolitical tensions dampened investors‘ appetite for risk and excitement over the Ethereum merger began to wane. Traditional markets were equally risk-averse, with the dollar strengthening against major fiat currencies except for the yen, with losses in equity markets. S&P 500 futures fell 0.3%, hinting at a rough start on Wall Street. The source of market unease was Beijing’s warning to US House Speaker Nancy Pelosi not to visit Taiwan – an island claimed by China – during her four-nation Asian tour that began on Monday.

“There will be heavy consequences if she insists on the visit,” warned Chinese Foreign Ministry spokesman Zhao Lijian. “We are fully prepared for any eventuality. The People’s Liberation Army will never sit idly by. China will take strong measures to protect its sovereignty and territorial integrity.”