Trump became country's 'first crypto president' during first year in office, former CFTC regulator says

Trump's administration greenlit the launch of bitcoin futures contracts at the CFTC

Biden administration has been ‘behind the 8 ball’ on crypto: Brad Garlinghouse

Ripple CEO Brad Garlinghouse joins ‘Mornings with Maria’ to weigh in on the cryptocurrency market, arguing that the market will double in size by the end of 2024.

Former President Donald Trump may have successfully wooed pro-crypto voters last week with promises to embrace the burgeoning digital asset market if elected president once again, but his street cred in the crypto industry dates back as far as 2017, one former regulator says.

In remarks made at a crypto policy summit held in Washington, D.C., on Wednesday, Chris Giancarlo, former chairman of the Commodity Futures Trading Commission (CFTC), said Trump already holds the title of "America’s first crypto president," and has done so since his first year in office when his administration greenlit the launch of bitcoin futures contracts at the CFTC.

"In addition to announcing he’s now ‘good with it’ — crypto, that is — Trump may justifiably claim to be ‘America’s first crypto president,’" Giancarlo said. "That is because of the launch of regulated bitcoin futures in the first year of the Trump presidency."

NEW COURT FILINGS SHOW SEC, CHAIR GENSLER BELIEVED ETHEREUM WAS A SECURITY FOR AT LEAST A YEAR

"The enduring success of that regulated futures marketplace has helped ensure that the world’s first digital commodity — bitcoin — is priced in U.S. dollars," he continued, calling it an important achievement for the future of digital assets.

Crypto, Giancarlo said, was not political in 2017 when he and fellow CFTC commissioners were "unified in support of regulatory innovation."

Trump's administration greenlit the launch of bitcoin futures contracts at the CFTC. (James Devaney/GC Images | istock / Getty Images)

Now, seven years later, cryptocurrency is poised to become a political issue for the first time in a presidential election following Trump’s remarks at an event in Florida last week that he would, if elected, end the "hostility" the crypto industry has faced from Biden regulators and Democratic lawmakers.

Trump encouraged the crowd to vote for him if they liked crypto "in any form," even hinting he may start accepting campaign donations in cryptocurrency.

His words sparked huge excitement from the crypto community on X, as well as calls to back him from leading industry voices, causing some media speculation that the former president may have just secured himself a whole industry's worth of votes come November.

The crypto industry, determined to make its voice heard in the election, has raised more than $100 million through so-called super PACs, with major crypto firms like Ripple and Coinbase giving large donations. Individual donations to pro-crypto candidates like Massachusetts Senate candidate John Deaton and Ohio Senate candidate Bernie Moreno are also ramping up just six months away from November.

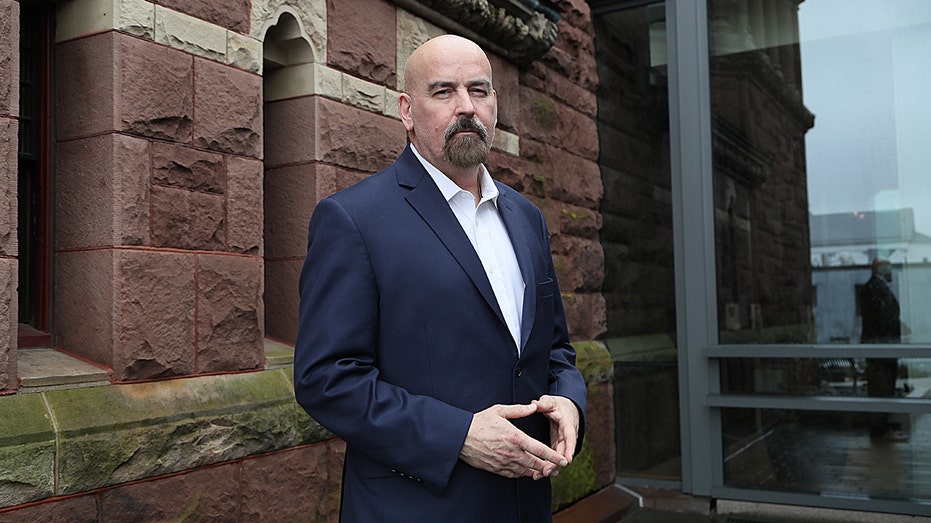

John Deaton, a Republican Senate candidate from Massachusetts. (Suzanne Kreiter/The Boston Globe via Getty Images / Getty Images)

CRYPTO INDUSTRY FIGHTS BACK AGAINST GOVERNMENT CRACKDOWN

President Biden, meanwhile, has often upset the voluble crypto crowd since being in office, largely thanks to his Securities and Exchange Commission (SEC) Chairman Gary Gensler, who has brought a myriad of enforcement actions against some of the biggest companies in the space, and Sen. Elizabeth Warren, D-Mass. who has touted building an "anti-crypto army."

Sen. Elizabeth Warren, D-Mass., speaks at a Senate Banking, Housing, and Urban Affairs Committee hearing in Washington, D.C., on March 7. (Al Drago/Bloomberg via Getty Images / Getty Images)

Under Biden, the SEC and the CFTC have battled over who should have jurisdiction over the $2 trillion crypto industry while Congress struggles to pass bipartisan legislation that would settle the matter. In the meantime, the industry has been trying to glean clarity from various courts with judges who are also at odds over whether digital assets should be regulated as commodities or securities.

The result has been growing animosity from crypto participants who see the federal government as trying to quash their livelihood.

Prominent crypto billionaires like Cardano and Ethereum founder Charles Hoskinson have taken to social media following Trump’s remarks, saying that a Biden win in November would further hurt the industry.

COINBASE DUNKS ON TRADITIONAL PAYMENT METHODS IN $15M NBA AD SPEND

By contrast, Giancarlo says that the Trump administration’s approval of bitcoin futures contracts has helped strengthen the power of the dollar by bolstering its reserve currency status. He points out that bitcoin, now trading above $60,000, recently surpassed the Swiss franc as the world’s 13th largest currency and that crypto is "not going away."

Bitcoin futures also helped pave the way for the January launch of 10 spot bitcoin ETFs (exchange-traded funds) that track the daily price of the world’s largest digital currency. The launch was hailed as a watershed moment for the industry as it was finally legitimized on Wall Street by major asset managers like BlackRock and Fidelity, who could now offer crypto exposure to their clients in the highly regulated ETF format.

Trump’s critics say his sudden "180" on crypto (in June 2021, he said bitcoin "seems like a scam" that threatened the dominance of the dollar) is merely a clever ruse to gain votes from a passionate group of people who feel marginalized, even attacked, by the current administration.

Some crypto industry participants say they felt the same way under the regulatory eye of Trump's SEC chair Jay Clayton, who bought 56 crypto-related enforcement actions throughout his four-year tenure. By contrast, Gary Gensler has brought over 90 since the start of his chairmanship in April 2021.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Giancarlo, who served under a Democratic and a Republican administration while at the CFTC, is no stranger to the political playbook, but points to Trump’s administration crafting a "groundbreaking regulatory regime for crypto" with the establishment of bitcoin futures as "proof that U.S. regulators can successfully regulate crypto if they are willing to do so."